Featured Content

AmeriCU Credit Union wins national award

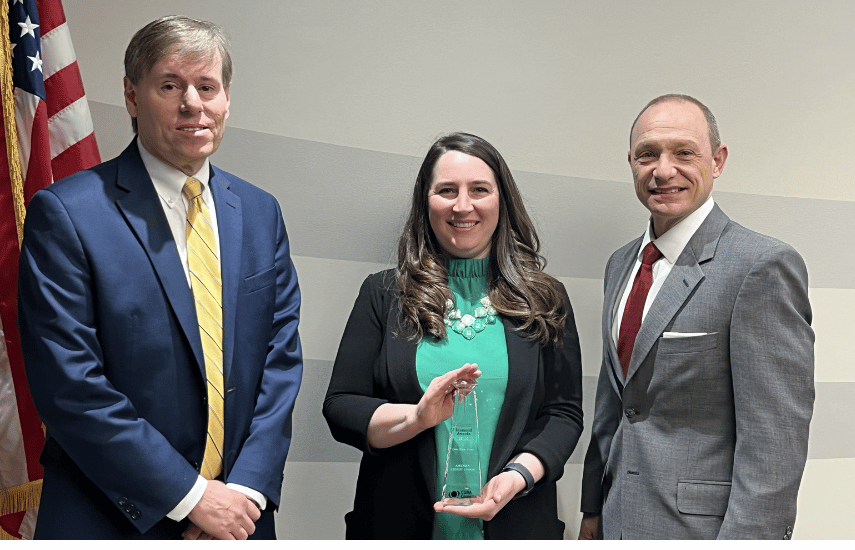

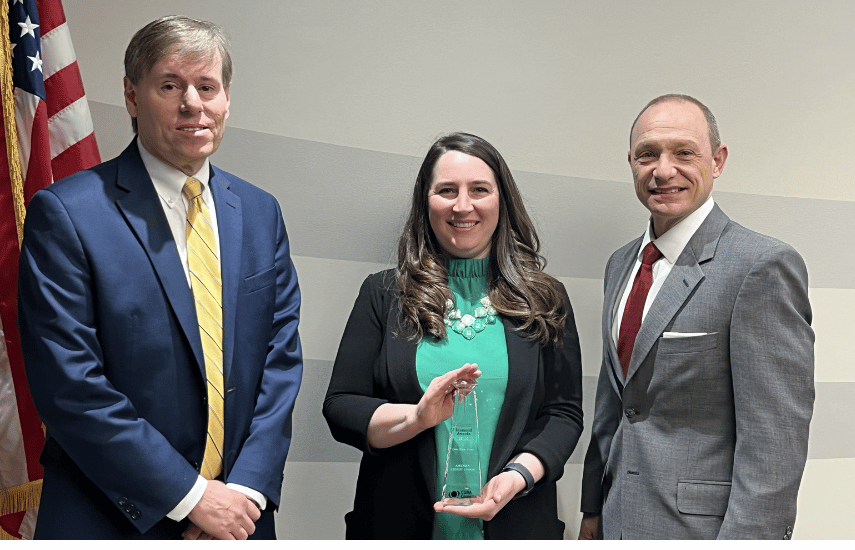

AmeriCU Credit Union has won a Diamond Award by America’s Credit Unions Marketing & Business Development Council for co-hosting the Tunnel to Towers 9/11 NEVER FORGET Mobile Exhibit. The annual Diamond Awards recognize outstanding achievements in the credit union industry.

AmeriCU Credit Union to make national television debut, showcasing commitment to financial excellence

AmeriCU Credit Union is proud to announce it is currently featured on Viewpoint, a public television program, highlighting the credit union’s pivotal role in the financial industry. During this educational documentary, CEO, Ron Belle and COO, Alissa Sykes Tulloch discuss the importance of how credit unions like AmeriCU support their members and the communities they serve.

Filter By

April 19, 2024

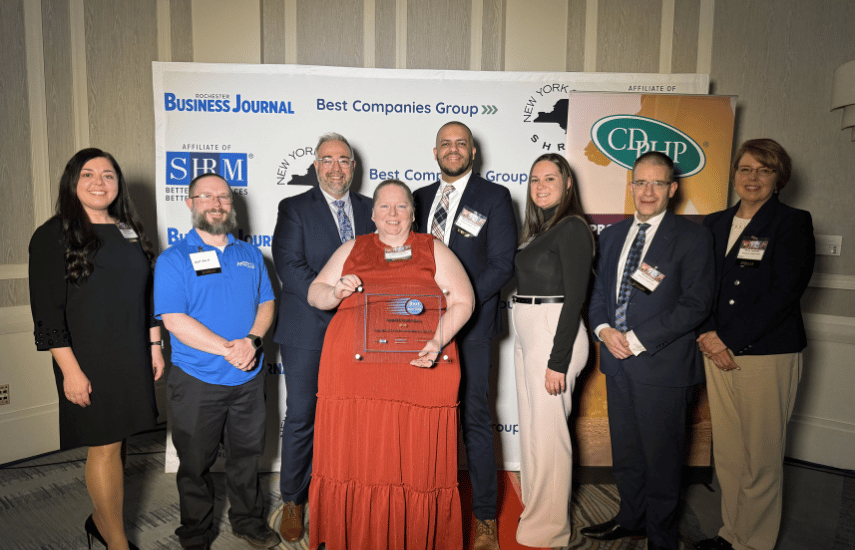

AmeriCU Credit Union named one of the best companies to work for in New York for the eighth year

AmeriCU Credit Union has been named one of the Best Companies to Work for in New York State for the eighth year. This recognition underscores the credit union’s commitment to fostering a positive work environment and cultivating a culture of excellence.

April 12, 2024

Budgeting for Families

Does the idea of setting a household budget sound intimidating? You’re not alone—in fact, one report shows that only 2 out of every 5 families use a household budget to take control of their finances.

May 21, 2024 | 6:30 pm

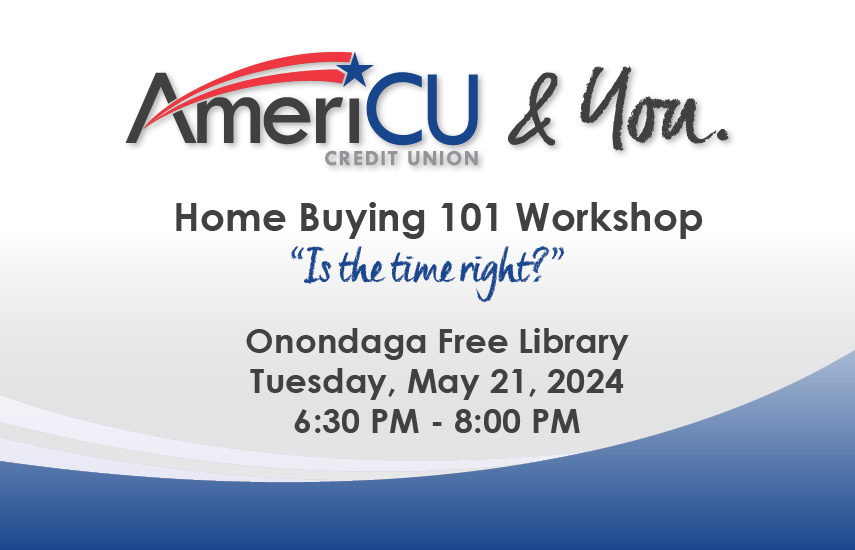

Home Buying 101 Workshop

Make homeownership a reality with AmeriCU Credit Union. Join the credit union for an educational workshop on Tuesday, May 21, from 6:30 – 8:00 PM at Onondaga Free Library, 4840 West Seneca Turnpike Syracuse, NY 13215.

April 3, 2024

AmeriCU Credit Union wins national award

AmeriCU Credit Union has won a Diamond Award by America’s Credit Unions Marketing & Business Development Council for co-hosting the Tunnel to Towers 9/11 NEVER FORGET Mobile Exhibit. The annual Diamond Awards recognize outstanding achievements in the credit union industry.

April 1, 2024

AmeriCU Credit Union celebrates Eclipse Day with festive offers

AmeriCU Credit Union is excited to announce they have twelve financial centers in the path of totality. The credit union is celebrating this once in a lifetime event with fun social media giveaways, financial center celebrations, loan discount offers, and new “totality” awesome checking accounts.

March 29, 2024

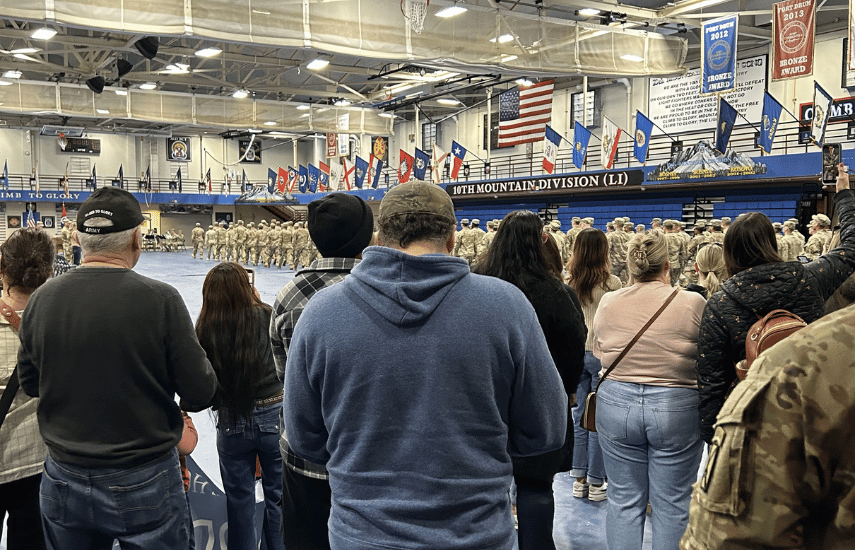

Welcome home 2nd Brigade Combat Team, 10th Mountain Division

AmeriCU Credit Union expresses gratitude to the brave soldiers of the U.S. Army 10th Mountain Division, their families, and community, for their remarkable service and selfless sacrifices in service to our nation by attending the Welcome Home Ceremony of the 2nd Brigade Combat Team.

March 25, 2024

AmeriCU Credit Union to make national television debut, showcasing commitment to financial excellence

AmeriCU Credit Union is proud to announce it is currently featured on Viewpoint, a public television program, highlighting the credit union’s pivotal role in the financial industry. During this educational documentary, CEO, Ron Belle and COO, Alissa Sykes Tulloch discuss the importance of how credit unions like AmeriCU support their members and the communities they serve.

March 19, 2024

American Heart Association and AmeriCU join forces to champion children’s health

AmeriCU proudly supports the American Heart Association on their mission of building healthier lives, free of cardiovascular diseases and stroke. This year, AmeriCU is the proud Heart Healthy Passport Sponsor at the Heart Walk events taking place in Syracuse and Watertown. Youth who participate receive a passport to explore booths, engage in activities, visit AmeriCU for a final task, and win a prize for their completed passport.

May 04, 2024 | 8:00 am

North Country Heart Walk

Join your friends, family, and co-workers to be a relentless force for a world of longer, healthier lives.

We’re all tied to heart disease and stroke in some way, and we must change that. By registering for the Heart Challenge today, you are taking the first step to save lives.