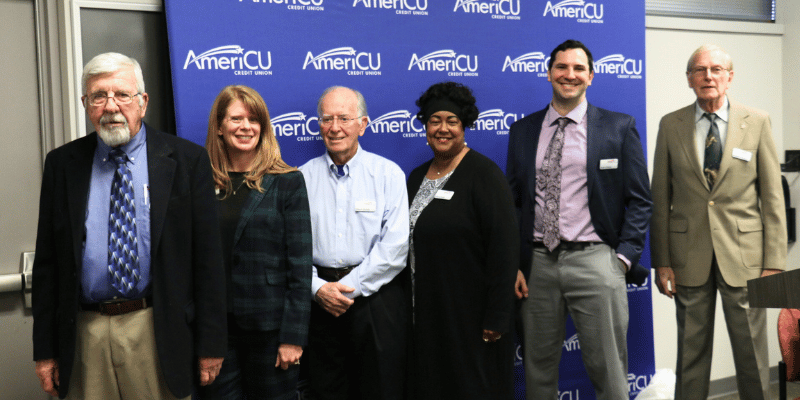

Meet the Board of Directors

Board Updates

Results of Board of Directors Election

March 11, 2024

The 2023 Slate of Officers is:

- Nicola Fabrizio, Chairman

- Jennifer Stowell, Vice Chairman

- Ryan Kuhns, Recording Officer

- Terri Tulowiecki, Chief Financial Officer

- George C. Bauer, III, Director

- John A. Stevenson, Director

- Joseph J. Turczyn, Director

Members of the Supervisory Committee are:

- Glenn Gaslin, Chairman

- Robert J. Angelhow, Member

- Jaclyn Lawrence, Member

- Michael Sewall, Member

The 2023 – 2024 Nominating Committee chairman is Darlene Burns, and her Committee Members are Tom Harding and Nick Fabrizio.

Two Seats up for Election and Filled by: George Bauer, Incumbent; and Joseph Turczyn, Incumbent.

AmeriCU’s 73rd Annual Membership Meeting was held on Monday, March 13, 2023. The meeting was held in-person at AmeriCU’s Griffiss Financial Center located at 231 Hill Road in Rome, New York, and was also made available virtually.

Board Chairman John A. Stevenson, along with President and CEO Ron Belle, addressed the membership, highlighting the outstanding credit union achievements we saw in 2022, while laying the foundation for what we can plan to see in 2023.

Additionally we recognized our 12 scholarship winners. Learn more.

The results of the Board of Directors’ election are as follows:

2023 Slate of Officers

Nicola Fabrizio, Chairman

Jennifer Stowell, Vice Chairman

Ryan Kuhns, Recording Officer

Joseph J. Turczyn, Director

George C. Bauer, III, Director

John A. Stevenson, Director

Terri Tulowiecki, Chief Financial Officer

2023 Supervisory Committee

Glenn Gaslin, Chairman

Robert J. Angelhow, Member

Lester Burt, Member

Jaclyn Lawrence, Member

Mike Sewall, Member

Copies of AmeriCU’s 2022 Annual Report are available online at www.americu.org/about/annual-reports/, at your local AmeriCU Financial Center, or you can request a copy by calling our Member Contact Center at 800.388.2000.

The 2022 – 2023 Nominating Committee chairman is Darlene Burns, and her Committee Members are Tom Harding and George Bauer.

Three Seats up for Election and Filled by: Terri Tulowiecki, Incumbent; Jennifer Stowell, Incumbent; and Nick Fabrizio, Incumbent.

AmeriCU’s Supervisory Committee

On behalf of the Board of Directors, AmeriCU’s Supervisory Committee performs financial audit oversight, serving as a means of checks and balances at the credit union. Their responsibility is to ensure you are happy with AmeriCU’s products, services, and teammates at all times.

As a group, the Supervisory Committee must ensure that the Board of Directors and credit union management:

The Supervisory Committee is responsible for ensuring that the board of directors and management of the Credit Union:

• Meet required financial reporting objectives and establish practices and procedures sufficient to safeguard members’ assets.

• To carry out these responsibilities, the Supervisory Committee must determine whether:

○ Internal controls are established and effectively maintained to achieve the credit union’s financial reporting objectives which must be sufficient to satisfy the requirements of the supervisory committee audits, verification of members’ accounts and it’s additional responsibilities;

○ The credit union’s accounting records and financial reports are promptly prepared and accurately reflect operations and results;

○ The relevant plans, policies, and control procedures established by the board of directors are properly administered; and

○ Policies and control procedures are sufficient to safeguard against error, carelessness, conflict of interest, self-dealing and fraud.

If you have any comments, questions, or concerns, we urge you to contact any member of the staff, management, Board, or you may contact the Supervisory Committee through email at [email protected] or by mail at:

AmeriCU Credit Union

P.O. Box 164

Rome, NY 13442

Meet the Supervisory Committee

You may also be interested in

About

Founded in 1950 at Griffiss Air Force Base, AmeriCU is a member-owned credit union.

Annual Reports

Credit unions were formed on the principle of “people helping people.” Each year, AmeriCU continues to grow and evolve, but this philosophy remains unchanged.

News

Take a look at some exciting things happening at AmeriCU and in our local community!

Questions? Click the ‘Let’s Connect’ button in the bottom right-hand corner to get started!

Latest From AmeriCU

News

AmeriCU Credit Union’s President and CEO elected as new Director to CenterState CEO Board of Directors

AmeriCU Credit Union proudly announces the election of its President and CEO, Ron Belle, to the CenterState CEO Board of Directors. Belle will bring invaluable expertise and insight to the Board of Directors, driving positive change in Central New York.

Events

North Country Heart Walk

Join your friends, family, and co-workers to be a relentless force for a world of longer, healthier lives. We’re all tied to heart disease and stroke in some way, and we must change that. By registering for the Heart Challenge today, you are taking the first step to save lives.

Education

Budgeting for Families

Does the idea of setting a household budget sound intimidating? You’re not alone—in fact, one report shows that only 2 out of every 5 families use a household budget to take control of their finances.