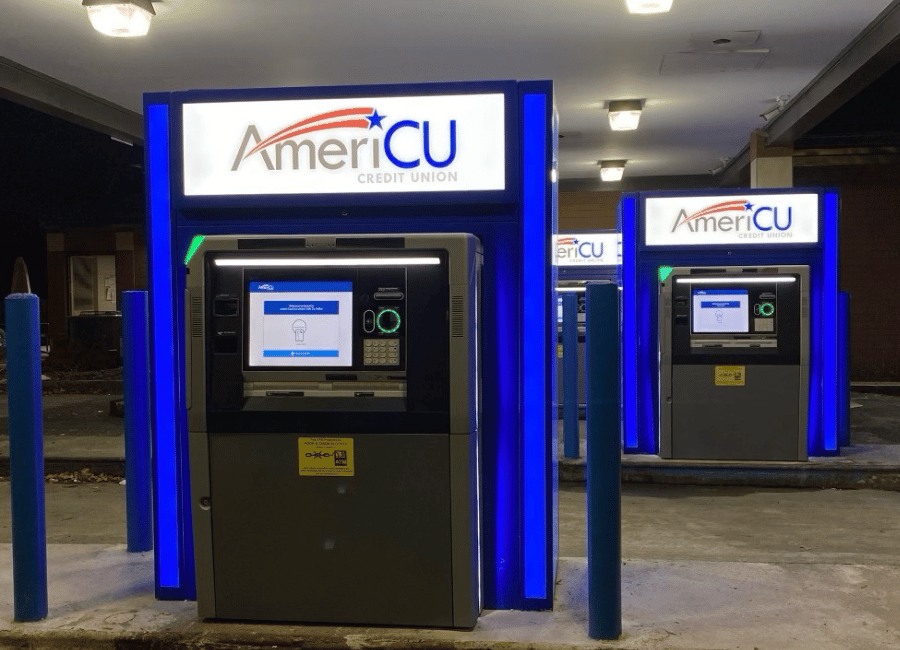

Interactive ATMs are Here!

An Interactive Teller Machine, or ITM, looks and operates as an ATM, with added functionality- including the option to chat directly with an AmeriCU representative, and perform virtually any transaction as if you were right at the teller line! Bank at your convenience with the flexibility of an ITM. Live Tellers provide extended service to our members outside of traditional banking hours – they’re available Monday – Friday from 9 AM – 5 PM, and on Saturdays from 9 AM – 12 PM.

Services offered at the ITMs include:

- Making loan payments

- Cashing checks

- Deposit up to 50 checks and 200 bills

- Transfer funds between accounts

- Withdraw cash in a variety of denominations

ITM Updates:

Soon, Drive Thru tubes will be replaced with ITMs at all of our Financial Center locations – but that doesn’t mean you need to step inside to conduct your transactions! Before you insert your card you can click the “Talk to Teller” button on screen and a live representative can assist you with any transaction you’d typically complete in the teller line! You can speak aloud to the Teller, or if you wish pick up the attached phone for some additional privacy.

NOTE: AmeriCU Interactive ATMs will display all accounts associated with your social security number (SSN), including primary and joint accounts. Not to worry! Your primary savings and checking account associated with your debit card will always display first. Just something to note when you’re performing a transaction! Questions? Let’s connect! Click “Let’s Talk” in right-hand corner to get started.

Questions? Click the ‘Let’s Connect’ button in the bottom right-hand corner to get started!

You may also be interested in

Locations + ATMs

Wherever you are, you’re never far from AmeriCU! With 20 Financial Center locations throughout Central and Northern New York, over 30,000 surcharge-free ATMs nationwide, and access to a nationwide Shared Branching network, we make it easy to connect.

Online + Mobile Banking

Access your accounts from your desktop or mobile, without ever having to visit a Financial Center, and take advantage of a variety of eServices.

Account Access

Always on the go? Or, maybe you prefer the comforts of home. Whatever your lifestyle, AmeriCU can connect you wherever you are!

Latest From AmeriCU

News

AmeriCU Credit Union’s President and CEO elected as new Director to CenterState CEO Board of Directors

AmeriCU Credit Union proudly announces the election of its President and CEO, Ron Belle, to the CenterState CEO Board of Directors. Belle will bring invaluable expertise and insight to the Board of Directors, driving positive change in Central New York.

Events

North Country Heart Walk

Join your friends, family, and co-workers to be a relentless force for a world of longer, healthier lives. We’re all tied to heart disease and stroke in some way, and we must change that. By registering for the Heart Challenge today, you are taking the first step to save lives.

Education

Budgeting for Families

Does the idea of setting a household budget sound intimidating? You’re not alone—in fact, one report shows that only 2 out of every 5 families use a household budget to take control of their finances.