Celebrating the 12th Salute to the Troops Tribute Concert

AmeriCU is grateful for our partnership with Fort Drum Family, Morale, Welfare and Recreation (FMWR) and the opportunity to show our appreciation for our Soldiers and their families. It has been a privilege to showcase this concert for the past twelve years, and we are truly honored to continue this tradition.

Commitment to Community Giveback

The AmeriCU team helped raise over $13,000 for Relay for Life of Central New York. This support contributes to the American Cancer Society’s mission to fight cancer.

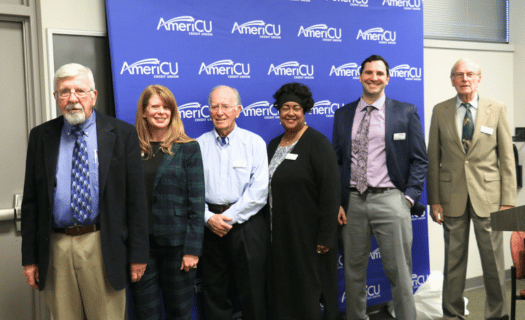

Herkimer Financial Center Grand Unveiling of New Remodel

AmeriCU’s Herkimer Financial Center has undergone a remarkable transformation to better serve our members. AmeriCU employees and community members celebrated the Financial Center’s renovation with a ribbon cutting ceremony on June 10.

Exciting Renovations Ahead to Enhance Your Banking Experience

The Cicero Financial Center will be the fifth financial center to be renovated to a welcoming and open design. These improvements will include a modernized interior and advanced technology for our valued members.

Financial Tip – Keep Your Mailing Address Up-To-Date

We’re confirming your mailing address for efficiencies and accuracy. The postal service then reviews the addresses and lets AmeriCU know if we need to make any updates. Learn how to verify your own address, and what to do if you’ve been e-mailed about an invalid mailing address of your own.

Dates to Know

- Saturday, August 3 | CanalFest

- August 5-14 | 38th Liverpool Annual Summer Concert Series

- Saturday, August 10 | Liverpool Free Mobile Shred Day

- Saturday, August 10 | Lewis County Open Farm Day

- August 10-12 | Solvay-Geddes Field Days

- Sunday, August 18 | Tunnel to Towers 5k

- Friday, August 23 | Cicero Let’s Connect Day

- Friday, August 23 | Lewis County Night Out

- Friday, August 30 | Watertown’s Downtown Block Party

You may also be interested in

In Our Community

AmeriCU values the importance of giving back to the communities where we live and work, it is part of who we are.

News, Events, and Education

Take a look at some exciting things happening at AmeriCU and in our local community!

Governance

Each year at our Annual Meeting, the membership of the credit union votes for members who will serve as Directors on our seven member, all-volunteer Board of Directors.

Questions? Click the ‘Let’s Connect’ button in the bottom right-hand corner to get started!

Latest From AmeriCU

News

AmeriCU Credit Union introduces emergency relief loan options for individuals and businesses affected by the storm

AmeriCU Credit Union is committed to supporting our community in times of need.

Events

Free Mobile Shred Day at Liverpool Financial Center

Join us for a FREE Mobile Shred Day!

Education

401(k) Plans

Saving money for retirement is one of the major financial milestones that everyone should carefully plan for in their lifetime.

*Applications subject to credit approval. Automatic payments required. Not valid on existing AmeriCU loans. Interest begins accruing on date loan is opened and will be amortized over the monthly payments. 0.25% APR rate discount valid on new and used ATV, UTV, Jetski, Dirtbike, Residential Equipment, RV and Boats, and is available for a limited time. Programs, rates, terms and conditions subject to change without notice. Offer expires 7/31/24.

**Applications subject to credit approval. Automatic payments required. Not valid on existing AmeriCU loans. Interest begins accruing on date loan is opened and will be amortized over the monthly payments. Programs, rates, terms and conditions subject to change without notice. Offer expires 7/31/24.