Savings Accounts

Share Savings

A safe place to let your money grow, and with just one penny, it’s where your membership with AmeriCU begins.

Youth Savings

Designed with our youngest members in mind to encourage them to start good savings habits at an early age.

Share Certificates

Our highest yield deposit option enjoys great rates, a wide variety of terms, and the freedom of investment flexibility.

Money Markets

High earning potential and greater flexibility, making it a great, low-risk choice for building savings.

Retirement Savings Accounts

Enjoy a variety of investment options to meet long, medium, or short-term retirement needs.

Health Savings Accounts

Enrolled in a High Deductible Health Insurance plan through your employer? You could be eligible to open an HSA.

Vacation Clubs

Saving with a specific goal in mind never hurts! Don’t just dream about your dream vacation, start saving up for it.

Holiday Clubs

Start saving early so when the time comes, you’re ready to deck the halls… and the walls… and the yard…

Questions? Click the ‘Let’s Connect’ button in the bottom right-hand corner to get started!

Latest From AmeriCU

News

AmeriCU Credit Union’s Virtual Financial Center Revolutionizes Member Experience

AmeriCU Credit Union’s Virtual Financial Center offers a convenient level of digital service and support for members to connect from wherever life takes them.

Events

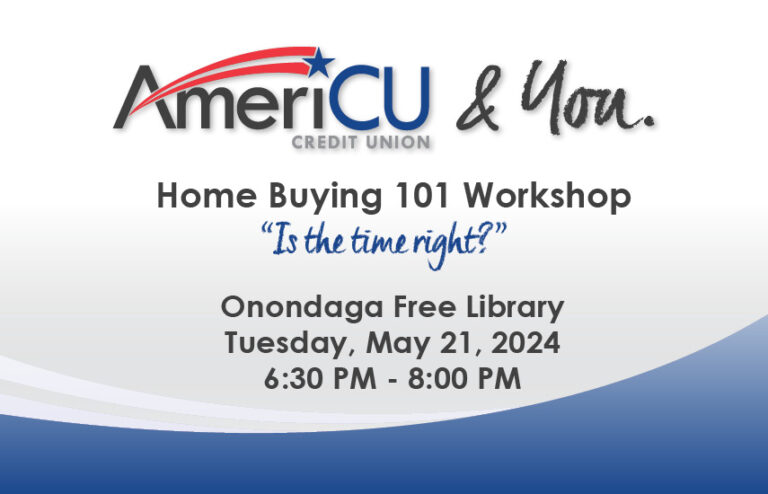

Home Buying 101 Workshop

Make homeownership a reality with AmeriCU Credit Union. Join the credit union for an educational workshop on Tuesday, May 21, from 6:30 – 8:00 PM at Onondaga Free Library, 4840 West Seneca Turnpike Syracuse, NY 13215.

Education

Mindful Living

Feeling stressed out? You’re not alone. In our daily lives, we experience many ups and downs.