We’re committed to improving your financial well-being.

Are you saving enough for retirement? Ready to start a college savings plan? Wondering if your portfolio could be better balanced? Worried about investment losses? We’re here to help. Let us put our experience, training and knowledge to work for you. It all starts with a no-cost, no obligation consultation. There’s no reason to wait. Call 800.352.9699 or schedule a consultation now to get started.

AmeriCU Investments

AmeriCU Investments provides retirement planning and financial advising services through LPL Financial (LPL), a registered investment advisor and broker-dealer.

Financial Counseling

AmeriCU has Certified Credit Union Financial Counselors available online and in-person at every location to provide our members with personalized financial wellness guidance and counseling.

Financial Education

We want you to have all the information you need to make good financial decisions. That’s why we offer free financial wellness and education services for both adults and kids.

Financial Services, Products, & Strategies Offered

- IRAs

- Mutual funds

- Annuities

- Long-term care insurance

- Life insurance

- Managed accounts

- Stocks and bonds

- Savings and investment strategies

- IRA rollover services

- Retirement income planning

- Investment management

- Insurance planning

- Tax-advantaged investment planning

- Estate conservation

- Education and funding

- Asset accumulation and distribution strategies

- Charitable giving strategies

Questions? Click the ‘Let’s Connect’ button in the bottom right-hand corner to get started!

Latest From AmeriCU

News

AmeriCU Credit Union’s Virtual Financial Center Revolutionizes Member Experience

AmeriCU Credit Union’s Virtual Financial Center offers a convenient level of digital service and support for members to connect from wherever life takes them.

Events

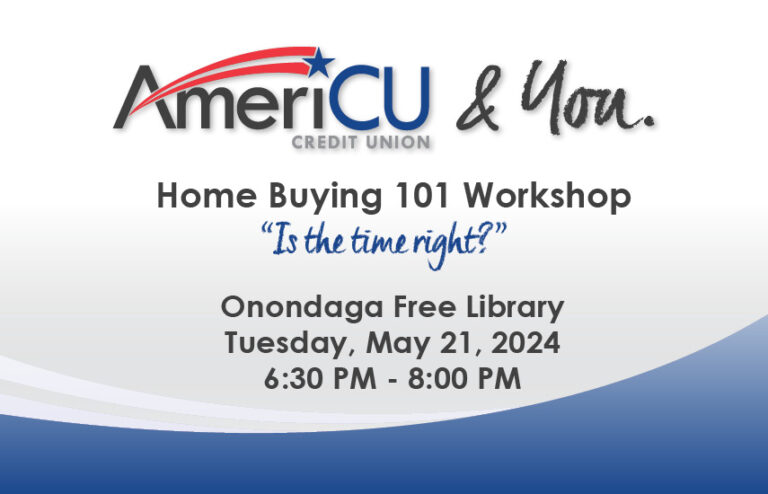

Home Buying 101 Workshop

Make homeownership a reality with AmeriCU Credit Union. Join the credit union for an educational workshop on Tuesday, May 21, from 6:30 – 8:00 PM at Onondaga Free Library, 4840 West Seneca Turnpike Syracuse, NY 13215.

Education

Budgeting for Families

Does the idea of setting a household budget sound intimidating? You’re not alone—in fact, one report shows that only 2 out of every 5 families use a household budget to take control of their finances.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risk including possible loss of principal.

Fixed and Variable annuities are suitable for long-term investing, such as retirement investing. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Variable annuities are subject to market risk and may lose value.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. AmeriCU Credit Union and AmeriCU Investments are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using AmeriCU Investments, and may also be employees of AmeriCU Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, AmeriCU Credit Union or AmeriCU Investments. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposits or Obligations | May Lose Value |

Your Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services.

Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html or scan the QR code below for more detailed information.

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.