Attention Legacy Mountain Valley Members: Important updates regarding the merger are now available. Please visit our Merger Information Page for details.

Attention Legacy Mountain Valley Members: Important updates regarding the merger are now available. Please visit our Merger Information Page for details.

![]()

Attention Legacy Mountain Valley Members: Important updates regarding the merger are now available. Please visit our Merger Information Page for details.

Attention Legacy Mountain Valley Members: Important updates regarding the merger are now available. Please visit our Merger Information Page for details.

![]()

When it comes to managing your business, you need a financial partner who will sit down and discuss solutions to help your business thrive. AmeriCU’s Commercial Loan Officers will help guide your business’s credit strategy. Whether you are consolidating high interest loans, expanding inventory, purchasing a delivery vehicle, protecting your checking account, refinancing property, purchasing an apartment complex, or expanding or relocating your business, AmeriCU is here to help.

AmeriCU’s Commercial Lenders will help guide you through the mortgage or lending process. And, our community focus and local decision making is complemented by competitive rates, flexible terms, exceptional service, and quick approvals.

AmeriCU participates in the Excelsior Linked Deposit Program (LDP) offered by Empire State Development. The LDP is an economic development initiative created to encourage and assist small businesses within New York. This reduced-rate financing program allows qualifying business to make investments to undertake eligible projects that will contribute to improving their productivity, performance, and competitiveness. The LDP helps strengthen small businesses by making borrowing less expensive.

Interested in LDP? Stop into one of AmeriCU’s Financial Centers to start the application process or contact us to learn more.

Featuring great, low rates, contactless payment, and zero liability from fraud, making them the perfect card for your everyday business needs!

Business Credit Card

Managing customers, cash flow and expenses can demand a lot of your time. That’s why AmeriCU has designed deposit account solutions with your business in mind.

Enjoy a seamless and personalized experience that meets the demands of your business with our online and mobile services including ACH, Automatic Bill Pay, Remote Deposit, and more.

Your business is big business to us! We’re here to protect your business, work directly with you and for you, and help evaluate the risk exposures specific to your commercial investment.

Questions? Click the ‘Let’s Connect’ button in the bottom right-hand corner to get started!

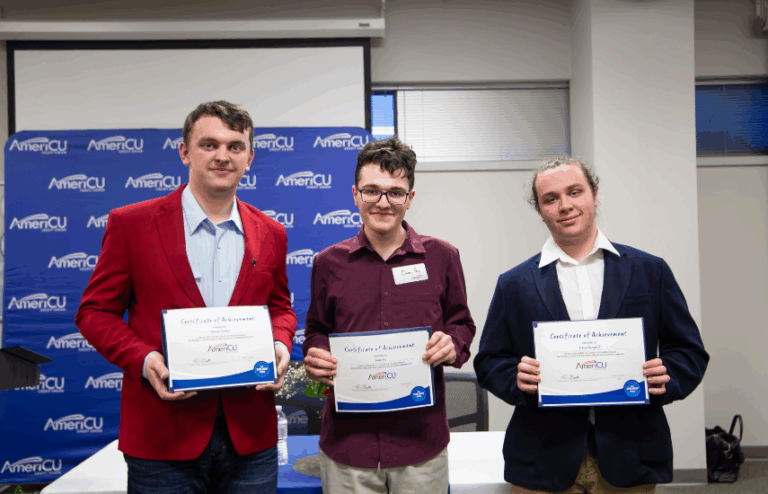

AmeriCU Credit Union is proud to connect 12 deserving students with a $1,000 scholarship toward their education.

In today’s fast-paced digital world, managing personal finances has become more complex—and more critical—than ever.