AmeriCU & Your Terms

6-Month Share Certificate – 5.00% APY*

Connect with low-risk earning potential! Time is money – let’s make the most of the next six months. You’ll be surprised how much you’re able to save in so little time.

View Disclosures and Rates Current Rates

Real Connections Matter

At AmeriCU, we believe today more than ever, real connections matter. Whether it’s connecting you with the right people to help you succeed, solutions to achieve your goals, or new technology to make banking even easier, AmeriCU has everything you need to connect you where you are with where you want to be.

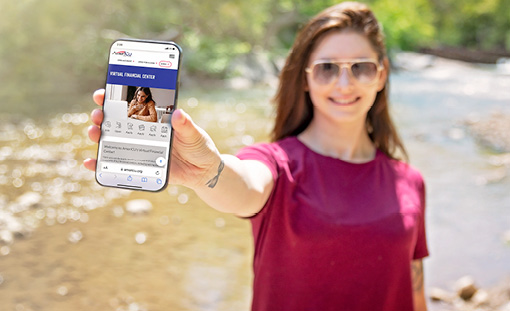

Connect Wherever Life Takes You

Our Virtual Financial Center with Live Video Assistance will connect you with a real AmeriCU representative who can help you:

Join the credit union; apply for a mortgage, loan, or credit card; open a new checking or savings account; and more.

AmeriCONNECT Visa Credit Cards

Connect with more features, more benefits, and even greater rewards! Right now, open an AmeriCONNECT Visa Credit Card and we’ll connect you with the lowest intro rate possible for the first twelve months.

Plus, qualifying members will earn reward points for every dollar spent!

About AmeriCU

As a credit union, AmeriCU is a not-for-profit financial institution owned by our members. Serving 24 counties in New York and beyond, AmeriCU provides you with all the products and services you need – often with low or no fees, and better rates.

The organization has been serving the local community for over 70 years and, in that time, has grown to more than 160,000 members, and 20 financial centers.

Questions? Click the ‘Let’s Connect’ button in the bottom right-hand corner to get started!

Latest From AmeriCU

News

AmeriCU Credit Union focuses on digital-first approach with a personalized touch to financial services by adding a new digital manager position

In an exciting move to support a digital-first approach with a personalized touch to financial services, AmeriCU Credit Union is excited to announce the appointment of Jenny Fox as the new Digital Marketing Manager.

Events

Liverpool Financial Center’s Let’s Connect Day

AmeriCU members and the community are encouraged to visit the credit union’s Liverpool Financial Center to learn about all the different services AmeriCU provides, all in one place! Meet with the right teammates and get the answers you need.

Education

How Businesses Use Credit

No matter where your business is in its journey, there’s a chance that you may need to take out a loan or find other sources of financing to help your business grow.

*Annual Percentage Yields (APYs) current as of 01/30/24 and are subject to change without notice. Minimum balance of $500 required. Withdrawals of principal are subject to early withdrawal penalties. The Dividend Rate and Annual Percentage Yield are fixed and will be in effect for the initial term of the account. Membership eligibility required. Insured by NCUA.